Baar, Switzerland ‚Äì On May 10 Weatherford International plc issued a news release regarding measures taken by the company.Ã˝

The company said that it has executed a restructuring support agreement with a group of its senior noteholders that collectively holds or controls approximately 62 per cent of the company's senior unsecured notes. The proposed comprehensive financial restructuring would significantly reduce the company's long-term debt and related interest costs, provide access to additional financing and establish a more sustainable capital structure.

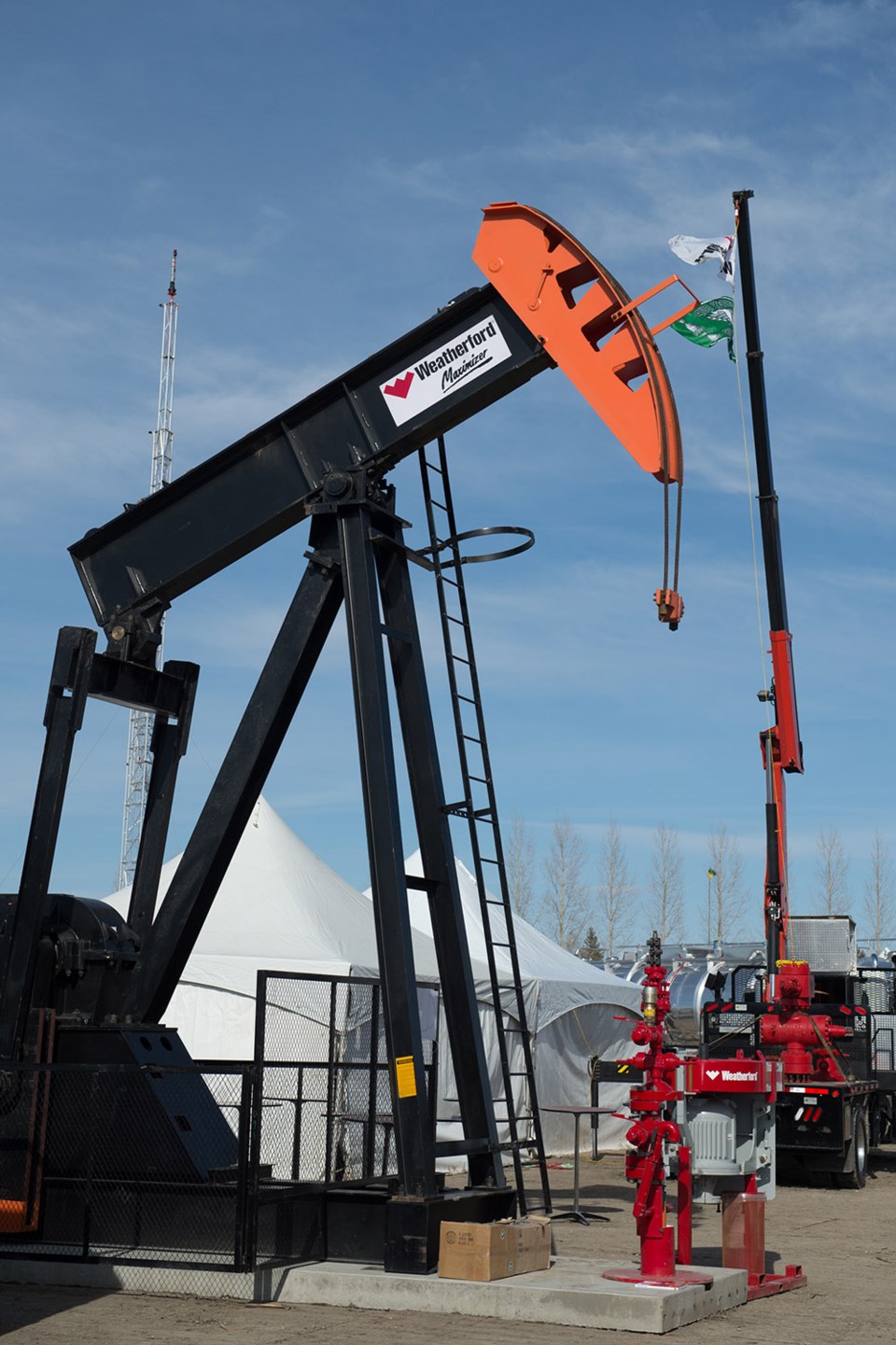

Weatherford is considered one of the four major global oilfield services companies, along with Schlumberger, Halliburton, Baker Hughes. However, of those four, Weatherford has the most significant presence in southeast Saskatchewan, particularly in Estevan.

The transaction results in pro forma net leverage at or below 2.7x at year-end 2019. The company's business plan implies significant free cash flow generation under the new capital structure, resulting in reduction of net leverage to 1.8x in 2020 and 1.2x in 2021.

Weatherford expects to implement the restructuring agreement through a “pre-packaged” Chapter 11 process and expects to file U.S. chapter 11 and Irish examinership proceedings (collectively, the “Cases”). As part of this process, Weatherford intends to continue engaging in discussions with, and begin soliciting votes from, its creditors in connection with a proposed Plan of Reorganization prior to filing.

‚ÄúDuring the past year, we have been executing a company-wide transformation to fundamentally improve the way we operate our business and to strengthen Weatherford for the long run,‚Äù saidÃ˝Mark A. McCollum, president and CEO of Weatherford.Ã˝‚ÄúDespite the challenging market dynamics our industry continues to face, we believe that our transformation strategy, which is designed to improve our execution capabilities, lower our cost structure and create efficiency to allow us to better price our products and services, will position Weatherford for long-term success.Ã˝However, we still face a high level of debt that affects our ability to make investments in our company and implement further elements of our transformation plan.Ã˝We are pleased that our noteholders recognize the long-term value Weatherford can create with an improved balance sheet as we work to achieve the full potential of our business transformation.Ã˝We expect that the new capital structure will allow us to continue to capitalize on our momentum and build a truly integrated service company with sustainable profitability and long-term growth potential.‚Äù

Business as usual

The restructuring agreement contemplates the company will continue operating its businesses and facilities without disruption to its customers, vendors, partners or employees and that all trade claims against the company (whether arising prior to or after the commencement of the Chapter 11 Cases) will be paid in full in the ordinary course of business.

McCollum said, ‚ÄúI would like to thank all of our valued employees, customers, vendors and partners for their ongoing commitment and support.Ã˝ We are taking these actions to ensure we can do an even better job of meeting our commitments to all of our key stakeholders by creating the strongest Weatherford possible. We do not anticipate any operational disruptions as a result of this announcement. Our customers, partners, employees and vendors should not experience any changes in the way we do business, and we expect their experience will improve after a restructuring is complete. We expect a restructuring will provide us with improved liquidity and greater financial stability and flexibility to make investments to enhance our platform while we continue to invest in the resources necessary for our business to grow. We are confident that these steps will allow us to continue our transformation journey and position Weatherford for long-term success.‚Äù

Financial restructuring terms

Under the terms of the restructuring agreement, the company's unsecured noteholders would exchange approximatelyÃ˝$7.4 billionÃ˝of senior unsecured notes for approximately 99 per cent of the equity in the company andÃ˝$1.25 billionÃ˝of new tranche B senior unsecured notes (the "Tranche B Notes"). (All funds reported in U.S. dollars.)

The restructuring agreement contemplates that Weatherford will receive commitments for approximatelyÃ˝$1.75 billionÃ˝in the form of debtor-in-possession (DIP) financing comprised of an approximatelyÃ˝$1.0 billionÃ˝DIP term loan that would be fully backstopped by certain members of theÃ˝ad hoc noteholder groupÃ˝and an undrawnÃ˝$750 million revolving credit facility provided by certain of Weatherford's bank lenders, which would be available as part of the chapter 11 process and be led byÃ˝CitigroupÃ˝subject to conditions to be agreed.

The restructuring agreement also contemplates a commitment of up toÃ˝$1.25 billionÃ˝in new tranche A senior unsecured notes (the "Tranche A Notes"), backstopped by certain members of theÃ˝ad hoc noteholder group, that would be funded at emergence to repay the DIP financing, pre-petition revolving credit debt, case costs, and to recapitalize the company at exit.

Pro forma for the transaction, the company would have up toÃ˝$2.50 billionÃ˝in total funded debt, which could be reduced based on several factors at exit. The size of the Tranche A Notes issuance can be adjusted downward by the company based on expected cash needs at exit and could result in a smaller issuance than theÃ˝$1.25 billionÃ˝Tranche A Notes backstopped by certain members of theÃ˝ad hoc group of noteholders. Additionally, up toÃ˝$500 millionÃ˝of theÃ˝$1.25 billionÃ˝of Tranche B Notes can, at the discretion of individual holders prior to emergence, be converted to equity at the midpoint of the chapter 11 plan equity value.

Based onÃ˝$2.50 billionÃ˝of funded debt at emergence and year-end expected cash of approximatelyÃ˝$500 million,Ã˝$750 millionÃ˝andÃ˝$1.18 billionÃ˝in 2019, 2020 and 2021, the company forecasts net leverage of 2.7x, 1.8x and 1.2x, respectively.

Ã˝