MOOSE JAW — Taxpayers owed more than $2.6 million in total tax arrears at the end of the fourth quarter, which was nearly 40-per-cent more than Q4 2023, while fewer people participated in payment plans.

City administration presented the fourth-quarter financial report during the Feb. 24 regular city council meeting, which included data about tax arrears, outstanding debt and how much each property class owed.

Council voted unanimously to receive and file the report.

Property tax arrears

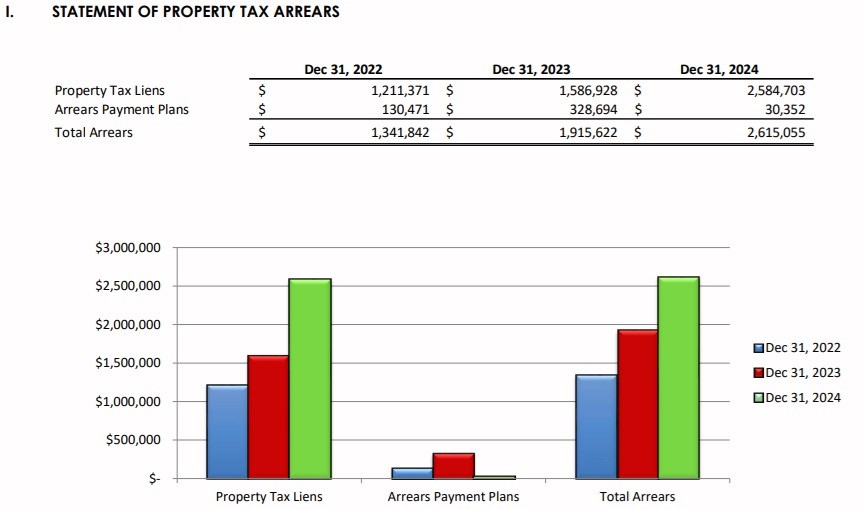

As of Dec. 31, 2024, taxpayers owed $2,615,055 in total arrears, which included $2,584,703 in property tax liens and $30,352 in arrears payment plans, the report said.

Conversely, by Dec. 31, 2023, those numbers were, respectively, $1,915,622, $1,586,928 and $328,694.

Therefore, the total outstanding amount of tax arrears increased by $699,433 — a jump of 36.5 per cent — from Q4 2023 to Q4 2024. This comprised a year-over-year increase in liens of $997,775 and a decrease in payment plans of $298,342.

Meanwhile, by Dec. 31, 2022, taxpayers owed $1,341,842 in total tax arrears, including $1,211,371 in property tax liens and $130,471 in arrears payment plans.

Property taxes receivable

Property taxes receivable consists of tax arrears and taxes owing. Tax arrears are overdue taxes, while current taxes are due but have not fallen into arrears. Taxes fall into arrears in the next year following the levy of taxes.

The total outstanding property taxes receivable by Dec. 31, 2024, was $5,048,738, including $2,433,683 in current arrears and $2,615,055 in outstanding arrears, the report said.

In comparison, total property taxes receivable that were outstanding by the end of Q4 2023 were $4,564,203, followed by $3,654,411 in 2022, $3,445,147 in 2021 and $4,769,061 in 2020.

There is “a very small bit of positive news” with property taxes receivable, as the current amount owing by Dec. 31, 2024, was $2,433,683 compared to $2,648,581 by Dec. 31, 2023, a difference of $214,898, said finance director Brian Acker. That current amount will turn into arrears come Jan. 1, 2026.

“We are seeing a little bit of a reduction in the increase of arrears from one year to the next,” he added, “and hopefully that’s a positive reflection on our citizens’ ability to meet their tax payment obligations and work with us going forward.”

“It’s concerning” to see high arrears continue, , but city hall is working on the issue and hopes to “make good headway,” Mayor James Murdock said after the meeting.

That headway includes having open communication with taxpayers, while seizing property would be a last resort, he continued. Meanwhile, the city will continue dialoguing with individuals about addressing this issue.

“Ideally it would be nice if they just paid their taxes,” Murdock added. “But … we’ll do whatever is possible to help that individual.”

Arrears by property class

At the end of 2023, the six taxable property classes owed $1,302,484.78 in outstanding arrears and $1,282,217.92 in 2022, the report said. This means those classes owed $2,584,702.70 during the last two years, while including payment plans of $30,352.57 increased that total to $2,615,055.27.

The arrears that people owed in 2023 and 2022 and the totals were:

- Other agricultural: $0 / $0 / $0

- Commercial and industrial: $451,263.74 / $255,051.42 / $706,315.16

- Multi-unit residential: $125,612.97 / $98,203.40 / $223,816.37

- Non-arable (range) land: $397.95 / $0 / $397.95

- Residential: $725,210.12 / $928,963.10 / $1,654,173.22

Compared to commercial/industrial, residential comprised roughly 58 per cent of all outstanding arrears by property class, the report said.

Borrowing/debt

As of Dec. 31, 2024, city hall was still repaying on six projects after borrowing money to finance them.

The principal outstanding amount on each project was:

- Multiplex long-term loan: $10,368,000

- Waterworks capital long-term loan: $19,577,000

- High-service pumphouse: $6,768,000

- Buffalo Pound Water Treatment Corporation (BPWTC) loan term loan (Bank of Montreal): $9,366,760

- Buffalo Pound Water Treatment Corporation loan term loan (TD Bank): $13,827,531.64

- Buffalo Pound Water Treatment Corporation loan term loan (Royal Bank of Canada): $14,161,225.74

These projects totalled $74,068,547.38, a decrease of $1,421,205.91 from the end of the third quarter. Meanwhile, the City of Moose Jaw’s debt limit is $95 million.

The next regular council meeting is Monday, March 10.